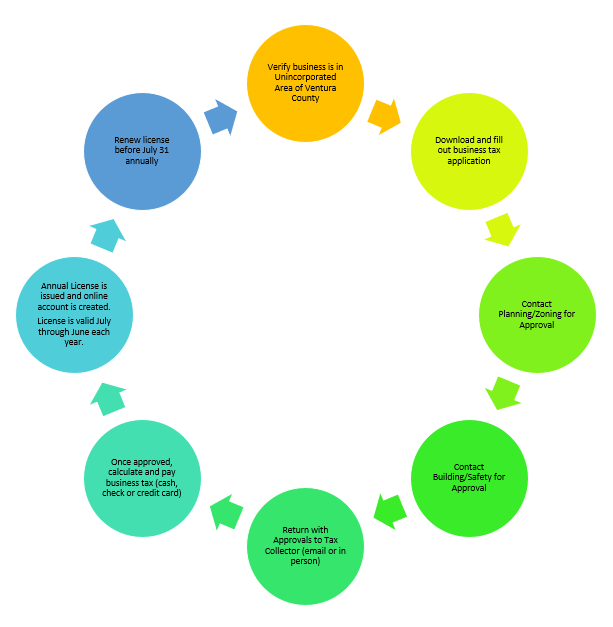

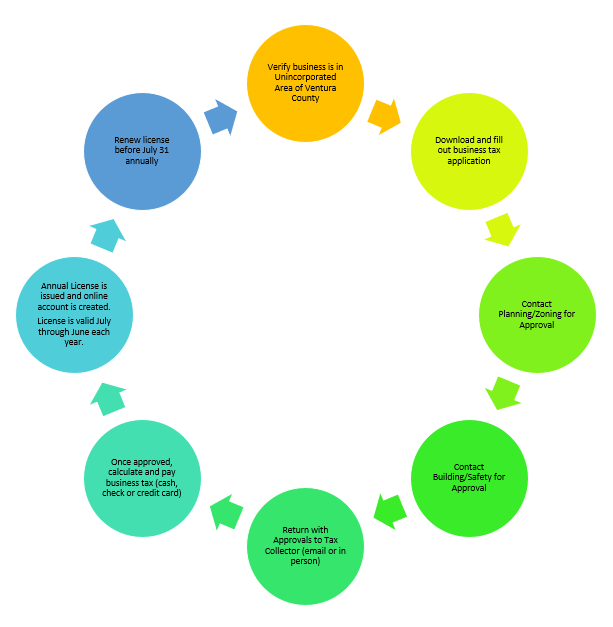

All businesses, professions, trades, vocations, enterprises, establishments, occupations and callings being conducted in the UNINCORPORATED areas of the county must obtain a Business Tax Certificate. This includes temporary businesses (e.g., film productions). Even businesses located within any city limits that deliver, solicit, or operate in the unincorporated areas of the county must have this certificate. Depending on business type and location, approvals and/or permits from other County of Ventura Departments may be required. At minimum, Planning/Zoning Department and Building/Safety are required. More than one Business Tax Certificate may be required depending on the types of activities the business is conducting. Certain trades will require an additional Regulatory License in order to operate. Those trades are: temporary show or concert, dance hall, hawker, pool table, pawn broker, junk collector or dealer, massage parlor, massage technician, rubbish collector, second-hand dealer, solicitor, taxi cab operator, itinerant merchant, bingo, etc. Transient Occupancy Taxes (TOT) is collected for all hotels, motels and short term rentals, in addition to the Business Tax Certificate. Please visit the link in the menu above for more information.

Every Business Tax Certificate needs approval stamps from Planning/Zoning and Building/Safety divisions of Ventura County RMA. Please use the button below to review the minimum requirements and for contact information.

Helpful Links to RMA’s website:

On October 2, 2019, the State of California passed Senate Bill 205, effective January 1, 2020, requiring certain regulated businesses to demonstrate enrollment with Stormwater Industrial General Permits (IGP) BEFORE cities may issue, or renew, a local business license.

What should a business do to comply with these requirements?

What if I have more questions about the State Stormwater Program?

Stormwater Hotline: (805) 650-4064 or (805) 645-1382.

Review the State’s Frequently Asked Questions.

Note: The County of Ventura does not administer or enforce the IGP.